Austria

Decline in retail space is accelerating

The decline in retail sales space that has been observed for the past 10 years has intensified in the last two years. The sectors of shoes, electronics, furniture, and clothing have been the hardest hit.

Moderate declines for the past 10 years

The last year with an increase in retail space was more than a decade ago: At that time, the food retail, furniture, and drugstore sectors still recorded strong growth. However, due to events such as the collapse of Schlecker and the sudden closure of nearly 1,000 locations, the balance turned negative. Since then, retail space in Austria has been steadily shrinking. Companies are expanding less, partially reducing their store sizes, and the recent increase in retail bankruptcies has led to further store closures.

COVID had a deferring effect

Since 2014, the average decline in retail space has been around 1.5% per year. Ironically, during the period of significant consumer restrictions, this figure dropped to below 1%, likely due to the extensive support measures provided by the government. However, a catch-up effect is now being observed: the reduction in retail space is increasing again, and this trend is expected to continue in the coming years.

Change in consumer behaviour

The high inflation of recent years has contributed to this trend, but the key reasons for the decline lie in the changing purchasing behavior of increasingly larger customer groups. The shift toward online shopping and the reallocation of spending toward dining, vacations, and leisure activities play a central role. Over the past 10 years, retail space has shrunk by about 18%, while the share of online sales has increased by the same amount. Brick-and-mortar retail has largely stagnated, while spending on dining has nearly doubled.

Not all sectors are losing out

During the observation period, the sectors that primarily offer short-term consumer goods recorded the most significant increases in retail space: food retail (+12%), drugstores (+21%), and pet supplies (+11%). However, growth in these areas has also slowed. For example, retail space in the food sector has remained stable for the past three years. Many frequently reported new openings are offset by a similarly high number of closures.

By far, the largest growth rates were recorded by non-food discounters such as Action, Tedi, Kik, and NKD, with an increase of 237%! Their retail space now significantly exceeds half a million square meters. This expansion has been further supported by available space from other sectors and a decline in rental prices.

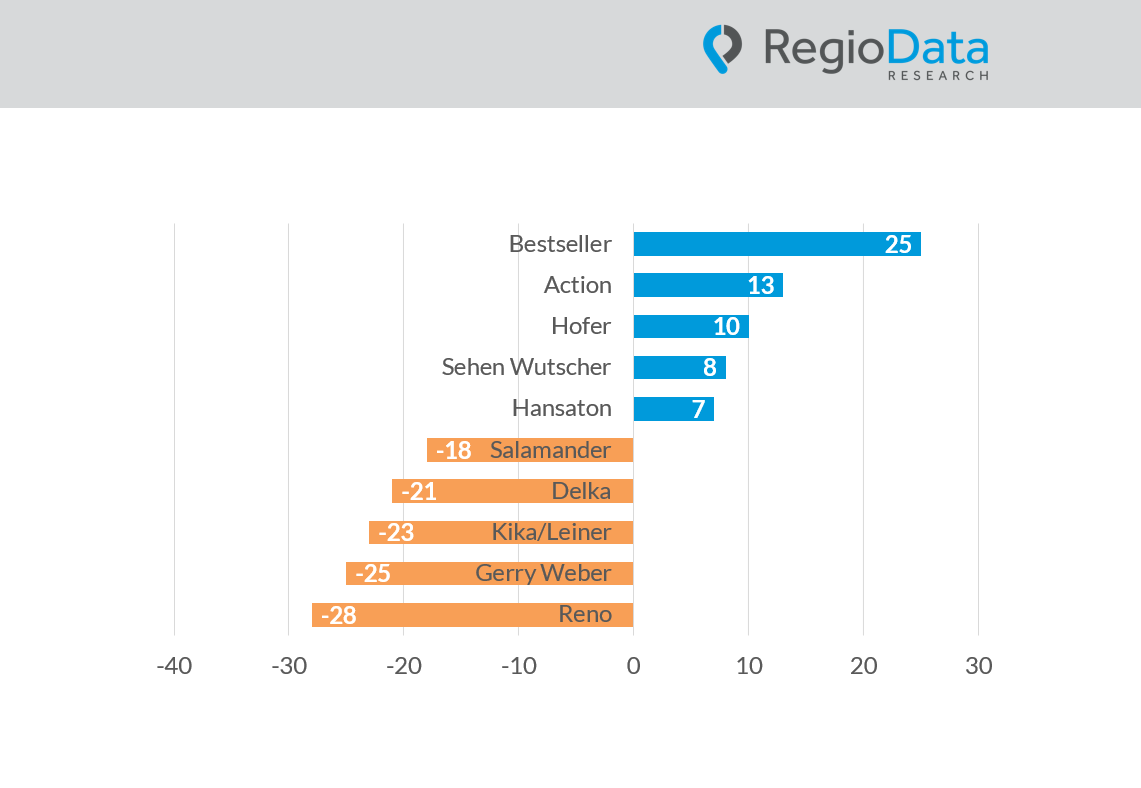

The biggest losers

The strongest decline in retail space was recorded by the electronics sector, with a decrease of 30%. This is not only due to the closure of larger individual stores but also because many smaller local electronics retailers have ceased operations. In the shoe sector, which also saw a significant decline of 20%, the difficulties or insolvencies of chain stores like CCC, Stiefelkönig/Delka, and Reno were key factors. The losses in the clothing, furniture, and sporting goods sectors are more moderate, with decreases of 7 to 8% each.

Other retail sectors, such as toys, watches/jewelry, leather goods, accessories, tableware, household goods, gifts, etc., were not surveyed in detail. However, these sectors are particularly affected by changing consumer behavior. The loss of retail space is estimated at over 40%, and further shrinkage is expected. The numerous, but mostly small, owner-operated stores have limited ability to adapt and often lack the necessary financial reserves.

Outlook

Currently, there are no signs that the decline in retail space will slow down or stop. Based on the revenue and profit developments in various sectors and the anticipated future consumer behavior, annual declines in retail space of around 2.5 to 3.0% can be expected in the coming years.

share post