Austria

Gastronomy Spending at Record High!

A look at the spending structure of Austrians reveals changed priorities: More and more money is being spent on gastronomy. Currently, 37% of total food expenses go to restaurants and cafés – a record high, highlighting that consumers are placing increasing value on enjoyment. Forecasts also point to further growth!

More gastronomy, gradually less retail

Currently, the average Austrian, from babies to grandmothers, has €27,000 available per year. Of this, around €4,990, or roughly 18% of total expenses, is spent on food.

A look at the past shows that Austrians have consistently allocated the same percentage of their budget to food retail over the years, while total food expenses have increased. However, it is noticeable that the focus has shifted: More and more money is being spent on gastronomy, while expenditures in retail have stagnated proportionally.

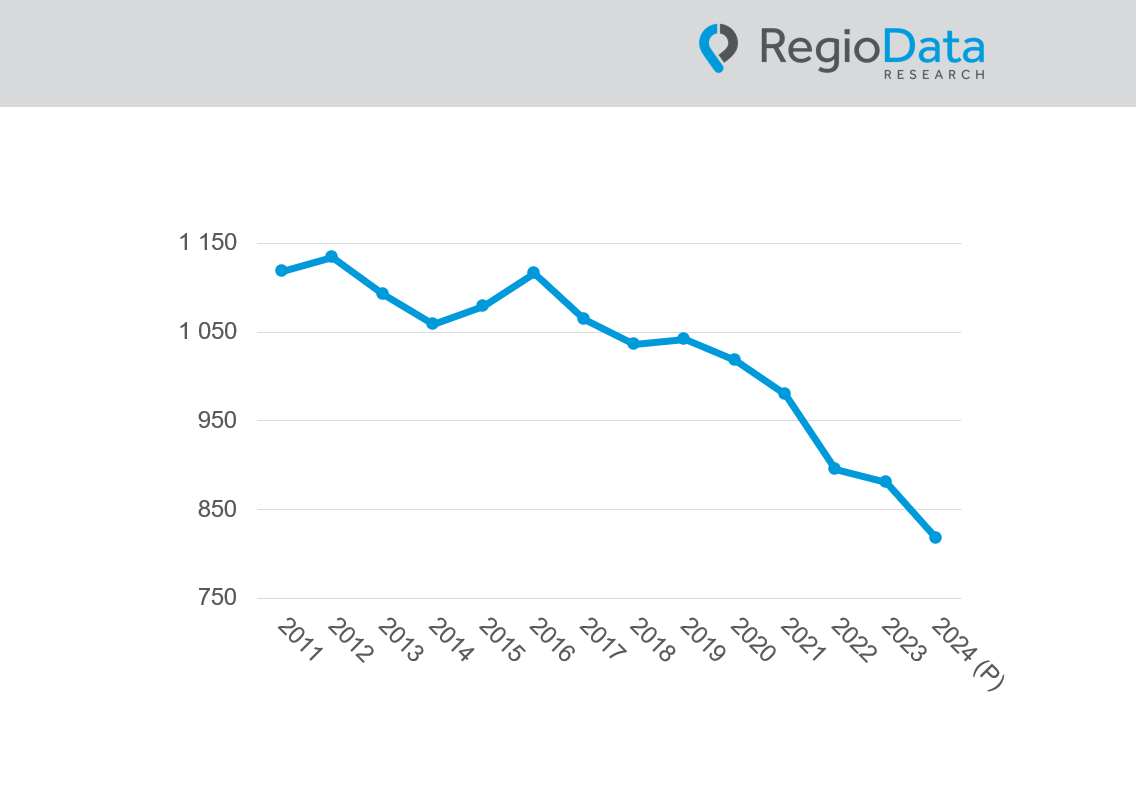

With a pre-COVID share of 34% of food expenses allocated to gastronomy, this figure has now risen to 37%, reaching a new national peak. By the end of 2024, RegioData Research even predicts an increase to 38%. Ten years ago, this share was just 29%, and has steadily risen since, apart from the COVID-related decline. Post-COVID, there has been an additional boom that is now unstoppable.

Leisure consumption in Austria: Twice as much pleasure

In Austria, spending on eating out is increasing rapidly: the average Austrian currently spends around €1,515 per year on gastronomic enjoyment. The largest share goes to traditional establishments – about €1,200 is spent on taverns, restaurants, and sausage stands. Another €200 is spent in confectioneries, coffeehouses, and ice cream parlors, while the remaining amount goes to catering services, delivery services, and similar offerings.

In 2013, leisure consumption per capita amounted to around €760. This means that spending in this area has doubled in the past ten years. In addition, around €330 per person per year is currently spent on meals at work and in school canteens.

Food industry remains cautious online

Despite the ongoing online boom in many sectors, the online share in the food retail industry in Austria remains low compared to other industries: In 2022, it was only about 2.8% of the total market, and even by 2024, this share is expected to stay below 3%. This figure includes both sales from domestic and international online stores of pure online providers as well as the online sales of brick-and-mortar retailers.

The perishable nature of products and the logistical challenges make online sales in this sector difficult. Additionally, Austria is one of the European leaders in supermarket density. The high availability of food markets, often within short distances, makes in-store shopping the preferred choice for many consumers, as it allows for quick and flexible purchases. Especially durable goods like wine, beverages, and specialty products dominate the online business. Nevertheless, in recent years, many brick-and-mortar retailers have upgraded and launched their own online stores, so a further increase in the online share of food retail is expected in the future.

Market concentration in the food retail sector increases

The Austrian food retail sector is now more concentrated than ever before: While the “Top 5” companies controlled 82% of the market in 2000, their share has now risen to a solid 95%. The two market leaders, Spar (35%) and REWE (32%), slightly expanded their positions last year, now holding a combined 67% market share. With Hofer (18%), the three largest providers control 85% of the market – more than the Top 5 did two decades ago. Lidl (7%) and M-Preis (3%) complete the top tier. The remaining market participants account for 5%.

Share post