Austria

Food retail - sales remain on a successful course

The Austrian food market defied the odds in 2022. The year was overshadowed by the impact of the Ukraine war and pandemic-related supply chain problems, yet these circumstances had less of a negative impact on the food market than expected.

Strong sales growth

In 2022, the Austrian food retail sector (primarily engaged in the retail sale of food) achieved a nominal sales growth of 4.3%, equivalent to a total volume of € 25.8 billion (gross). This result was due not least to the sensitively high price increases in the food retail sector. The average inflation rate for food and non-alcoholic beverages in 2022 was 10.7% compared with the previous year. The market is rising unabated, and this trend is expected to continue.

Strongest concentration among retail sectors

The top three food retailers, Spar, REWE, and Hofer, together account for around 84% of the total market and thus have the highest market concentration in the industry. Including 4th and 5th place, Lidl and M-Preis, the food retail industry has a concentration level of a whopping 95%. There is little room for maneuvering for the remaining market participants.

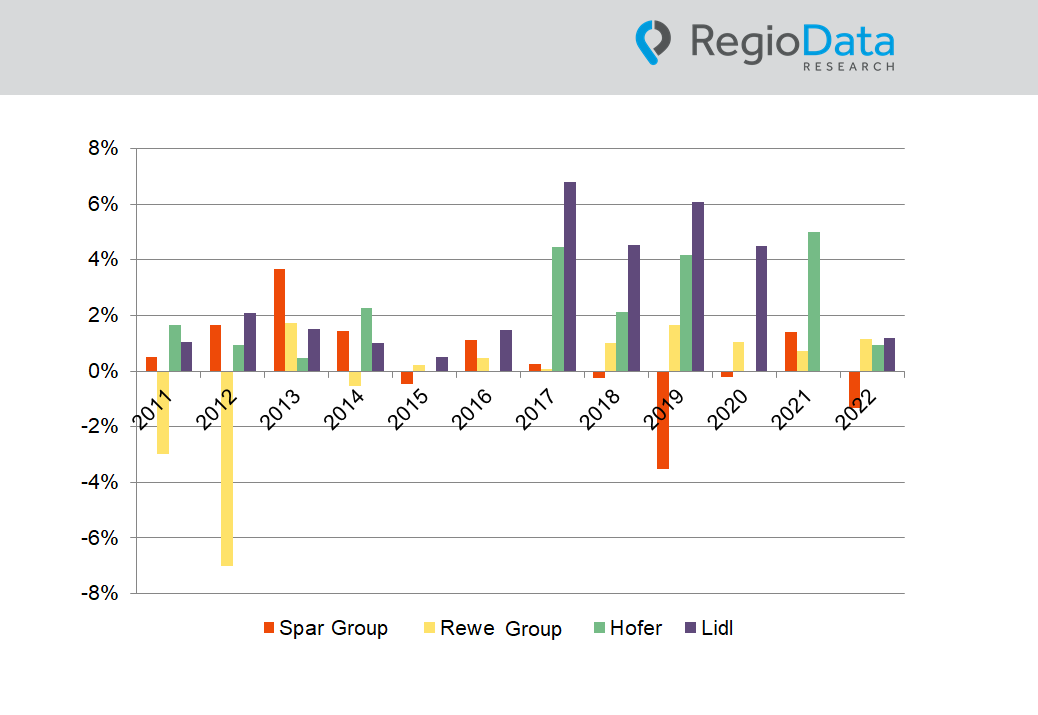

Spar holds the highest market share

With a market share of 35 %, Spar, including Eurospar, Interspar, and Maximarkt, remains the number 1 food supplier. The Spar Group has thus been able to maintain its market leadership in Austria in 2022, but not to expand it significantly. A market share of 31% makes REWE second place. Overall, the two industry giants increased their sales by 4.3% in 2022. Their market share remains unchanged at 66%. Hofer is in third place with a market share of 18%.

Discounters hold almost 1-third of market share

In 2022, the big players in the discount sector, Hofer, Lidl, and Penny, recovered and recorded a sales growth of 5.7%. The market share of discounters overall is 29.0%. Hofer, the number one in the discount sector, achieved a sales increase of 4.5% with a constant total sales area. The discounter accounts for a proud 61.5% of the discount sales in Austria. Lidl, as the number two, with a sales share of around 24.3% in the discount sector, reduced its sales area by 1.6% in 2022 and increased sales by 6.7%. Penny expanded its sales by 9.2% with a 1.3% increase in selling space.

Demand for alcoholic beverages declines

In the current observation year, private households have spent 4.5% more on product groups relevant to the food retail sector and now reach around €3,570 per capita per year. Products such as consumer goods, milk substitutes, butter, and cooking oil have increased significantly, while alcoholic beverages, frozen foods, and meat have declined. A clear trend towards a “healthier” lifestyle is emerging.

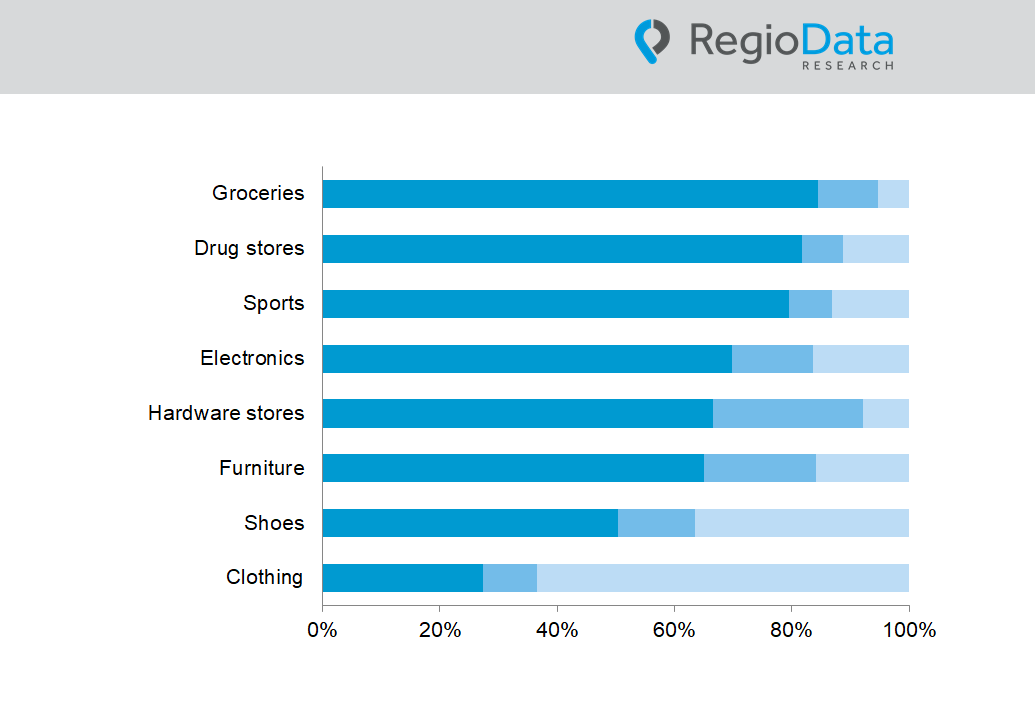

Online share remains low

Although the Covid pandemic has greatly benefited online commerce, the online share in the overall market remains relatively low despite significant investments by providers. In 2022, the online share was only 3.5%, which is relatively low compared to other industries. (This includes revenues from domestic and foreign online shops of pure players and multi-channel revenues of brick-and-mortar retailers.) However, it is also expected that the share of online commerce will continue to grow steadily in the future.

Share post