Austria

Online Retail 2024: Back on the Fast Track!

The annual RegioData analysis of online retail is the only evaluation in Austria that does not rely solely on surveys but examines the actual online sales of companies. Each year, over 1,000 online shops are analyzed.

Online sales are rising again – “business as usual”

Every Austrian currently spends an average of € 1,220 a year on online shopping. This figure has in fact been higher in the past: during the coronavirus pandemic, online spending briefly rose to €1,270. Clothing (€ 245 per capita) and electronics (€ 234 per capita) account for the largest share of annual online spending.

After the online share of retail-related consumer spending dropped for the first time from 16.2% in 2021 to 14.8% in 2022, the decline continued in 2023. The average online spend of € 1,220 currently only accounts for 14% of total retail-related consumer spending.

Despite the hard landing after the “COVID peak,” online retail is gaining momentum again. The recent declines in online retail have proven to be just a temporary “hiccup,” as the previous peak during the pandemic is expected to be reached again as early as next year.

New drive in online retail

Forecasts show continued dynamic growth for the coming years. New market players such as Temu and Shein are also contributing to this dynamic growth. Until now the two Chinese online pure players (as at the end of 2023) have not yet had a significant impact on sales in Austria. With estimated sales of EUR 70 million and EUR 95 million respectively, they are not among the top 15 most-used online stores and each have a market share of less than 1% of total Austrian online sales. Nonetheless, they are poised for significant growth in the coming years.

Every sensible merchant knows: Selling a women’s dress including delivery from China for less than €9 or sneakers for €3 can never be profitable. The strategy of these companies is clear: to build a large customer base and a strong image in a very short time, no matter the cost. Amazon acted similarly back in the day and incurred losses for years. The abolition of the customs exemption threshold for goods under €150, which interest groups are vehemently demanding, would probably have little impact. This alone would not be able to slow these companies down.” – DI Wolfgang Richter, CEO, RegioData Research

Firmly anchored: “Pure-Player Classics” continue to dominate the online top spot

The share of traditional retail companies that also have physical stores accounts for only 38% of the revenue. This means that almost two thirds of total Austrian online sales are generated by so-called “Pure Players”, i.e. purely online retailers.

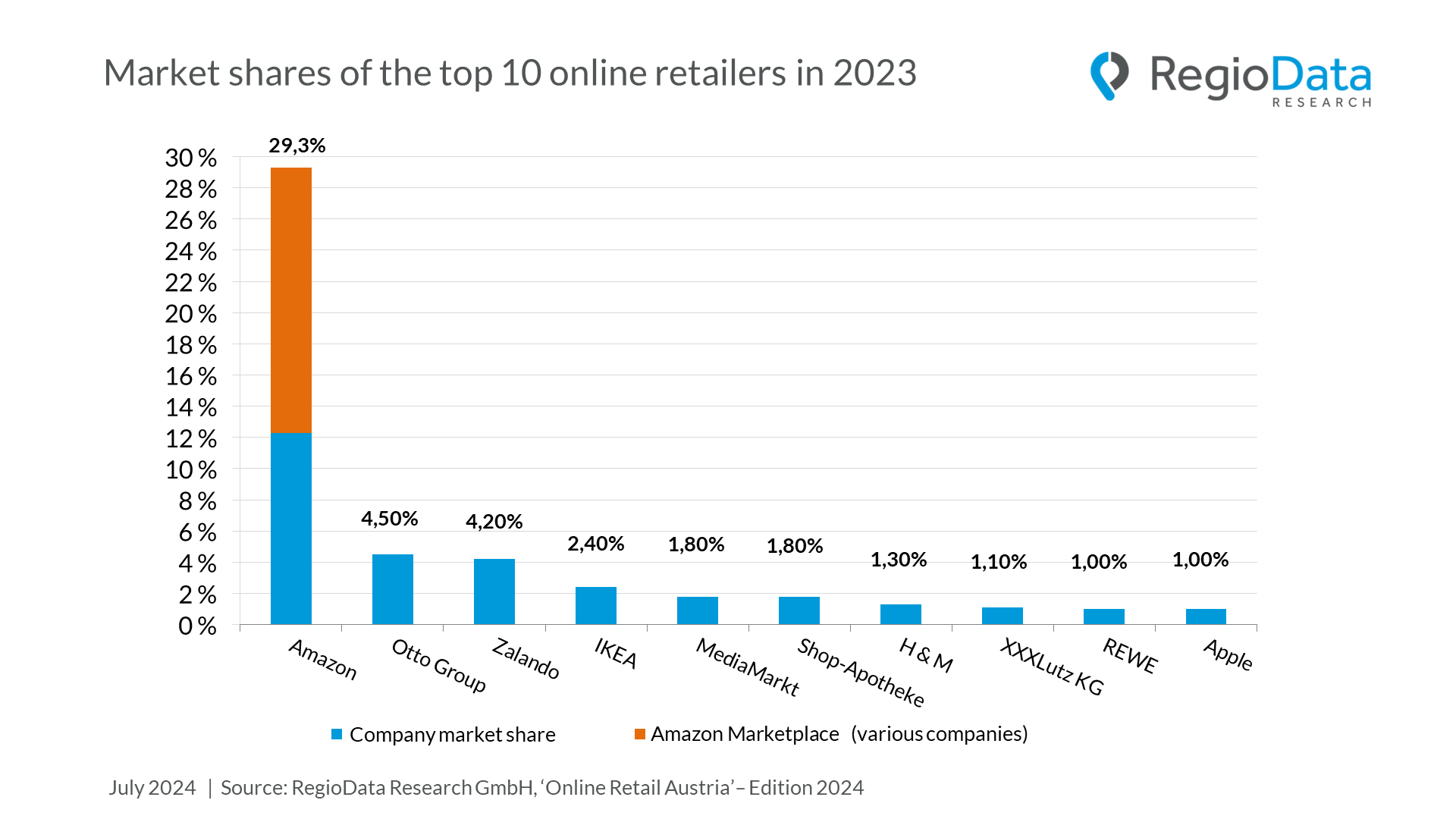

Undisputedly at the top are Amazon (market share 12.3% excluding Marketplace), followed by the Otto Group (with approximately 15 different shops) with a market share of 4.5%, and Zalando with 4.2%. Together, these three dominate about 21% of the Austrian market.

In 2023, only Amazon was able to further expand its dominant position, while the market shares of the Otto Group and Zalando slightly decreased. This keeps Amazon as the uncontested market leader. If Amazon Marketplace is included, this market share rises to just under 30%. In Germany, on the other hand, Amazon and Amazon Marketplace already have a market share of well over 50 % of total online retail.

The popularity of marketplaces is growing rapidly anyway, as they now account for over 33% of Austrian internet expenditures. The Amazon Marketplace leads the way, followed by eBay, and a growing number of smaller, niche-specific, or regional marketplaces. The most well-known Austrian marketplace, “shöpping.at,” plays a minor role in comparison.

The most significant multi-channel retailers in Austria include Ikea, MediaMarkt, and Hennes & Mauritz.

What is new?

The Shop-Apotheke, as an online pure player, has emerged as the rising star of the year and now ranks sixth in the Austrian revenue ranking. In contrast, the online shop of Münze Österreich experienced declines. For the first time, REWE has also made it into the top 10 Austrian online providers thanks to Bipa-Online and Billa-Online.

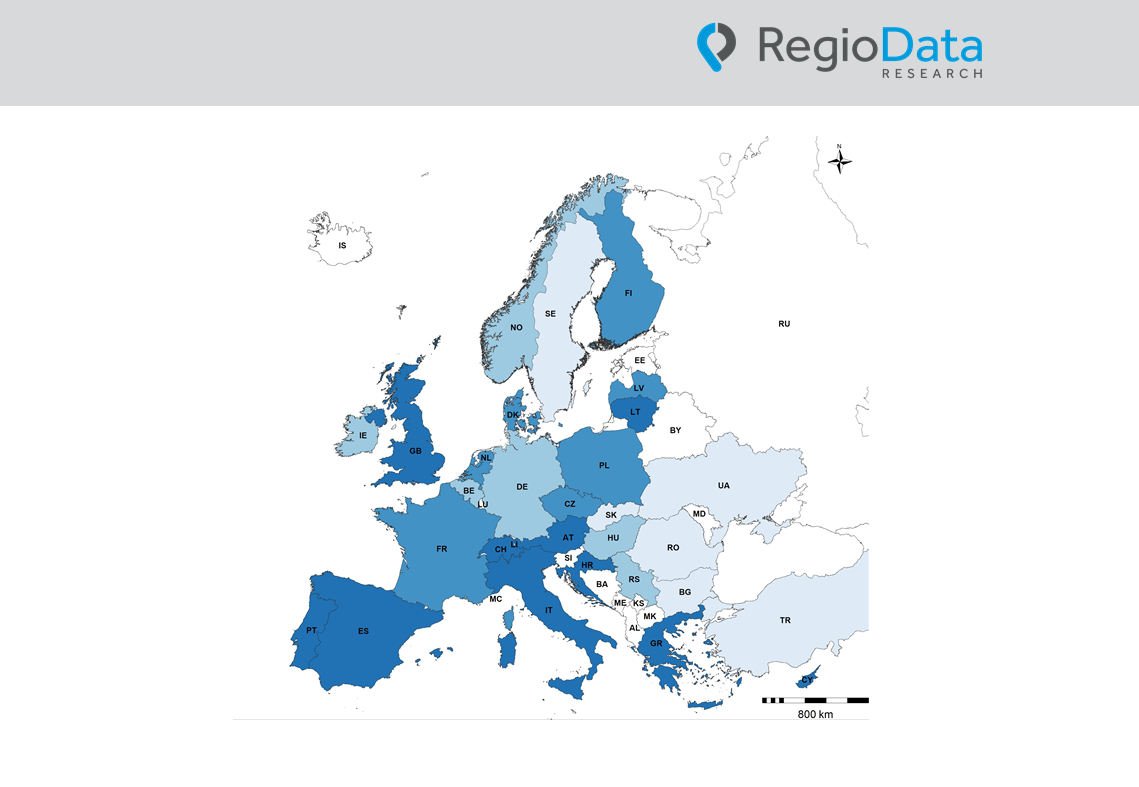

In the international comparison of online shares of consumer expenditures, Austria has lost ground and been overtaken by countries such as France, the Czech Republic, the Netherlands, and Switzerland. Consequently, Austria has slipped from seventh place in 2022 to eleventh place.

There have also been changes in the revenue structure: Of the annual online revenues amounting to approximately €11 billion, about 35% now remain with online shops based in Austria. This share has significantly increased from 27% during the COVID-19 years. The remaining 65% of revenues are generated by companies based abroad.

Industry overview: Electronics/computers lead, clothing and shoes remain stable

The electrical/computer product group currently has the highest online share of the sectors surveyed at 43%. The high-turnover fashion sectors of clothing (29%) and shoes (31%) are well behind, but have managed to hold their ground relatively well. The book and paper (27%), sport and leisure (21%) and personal durables (26%) sectors are ranked in the middle.

In the long-term segment, such as furniture and DIY products, the online share is currently around 11% and 16% respectively and has decreased minimally compared to the previous year. Online retail continues to play a minimal role in the food sector this year, with an online share of only 2.3% (compared to nearly 3% in 2021). The category of Games and Hobbies saw a significant decline this year, dropping by 3.4%. Similarly, there were slight decreases in the share for Drugstore products and Sports and Leisure items.

Beitrag teilen