Austria

Retail expansion 2023 - poor prospects for landlords

This year, as every year, RegioData Research has again investigated the expansion behavior of retailers, restaurateurs and retail-related service providers. The results are sobering.

Supply of leasable space higher than demand

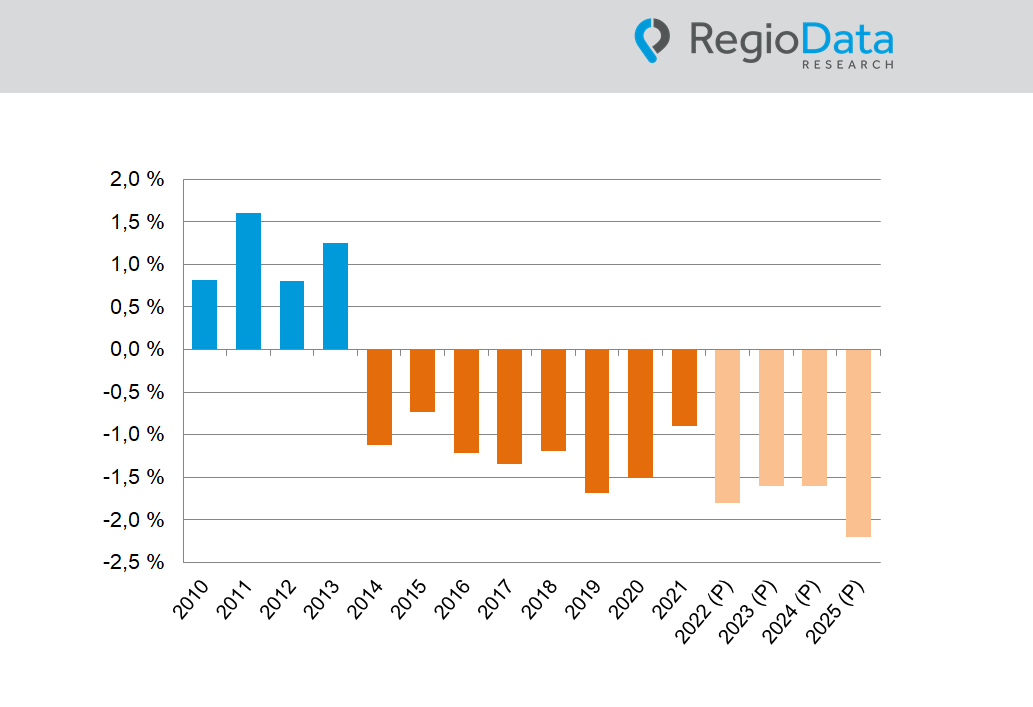

Summarizing the expansion intentions of the 700 active sales divisions of the chain stores in the retail and retail-related services sector in Austria, only about 750 new leases can be expected in this segment (chain stores) in the entire country this year. Five years earlier, it was about the double, and ten years ago it was even four times as much. Many companies are probably planning to open one or the other location. However, the time of space expansion is over for almost all companies.

The reasons do not lie directly with the Pandemic, but essentially with online retailing. A further role is played by the change in customer behavior that goes beyond this (more conscious shopping, less shopping,…).

This means that the supply of leasable space is generally higher than the demand, also reflected in the gradually rising vacancy rates in city centers, shopping malls and retail parks. The locations becoming vacant due to voluntary closures or insolvency are currently even higher than the space in demand.

Non-food discounters and bakeries very active

However, not all sectors are showing restraint with regard to their expansion. Non-food discounters, in particular (e.g. Action: already 95 locations in total, Pepco, Tedi), and pet retailers (e.g. Fressnapf: 140 locations in total) are currently expanding rapidly. A high level of dynamism can also be seen among bakeries, although the preferred locations here are limited in each case regionally.

Food retailers, too, have by no means halted their high expansion rate in recent years, but have slowed down considerably – similarly for drugstores.

Continuing reduction of locations in the clothing and footwear retail sector

In the clothing and shoe retail sector has been hardly any change in corporate strategies this year: For most of them, the motto is rather area or location reduction than expansion. Although there are always new market entrants, these “new” companies are usually content with no more than a handful of locations, especially those in the very exclusive sector or in niche segments.

Only a few of the numerous fitness center concepts, which were highly expansive just a few years ago, seem to be able to hold their own. All in all, more closures than new openings are expected here this year.

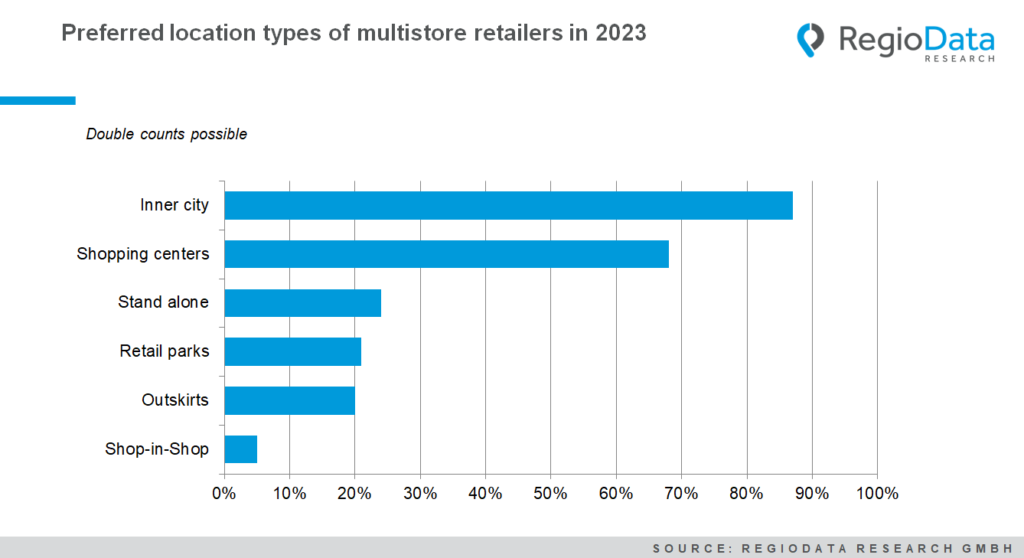

Busy city centers and shopping malls remain the target of expansion

However, there is sustained high momentum in system catering, both among the established market leaders and among newcomer concepts. But completely new forms of distribution are also looking for locations in isolated cases: car manufacturers, e-gaming providers, online pure players or service providers such as energy suppliers.

In general, demand for new locations will continue to decline this year. However, top locations, i.e. good city centers and shopping malls, will continue to have no problems due to their popularity.

Smaller locations with an average of 200 m2 have more chances

Depending on the retail sector, sales areas of between 100 m² and 200 m² or between 200 m² and a maximum of 500 m² are mainly sought. Areas up to 100 m² are particularly relevant for restaurants, bakeries and smaller shoe and clothing retailers. Requests for space in the 500 to 1,000 m² range are more likely to be found among larger clothing retailers as well as furniture retailers.

Share post