Austria

Retail locations 2025: Consolidation with occasional bright spots

RegioData Research’s annual expansion analysis shows that retail networks are growing very little, with retreat and consolidation dominating instead. Of the 732 examined retail chains from 24 industries, many are hitting the brakes. However, there are also companies that are eager to expand. Online retail and non-food discounters are pushing specialized retailers out – with noticeable consequences for the retail landscape.

Gastronomy remains growth driver – but more restrained

This year, gastronomy remains one of the few sectors with clear expansion efforts, albeit not as dynamic as in previous years. In particular, smaller and trendy concepts such as “Kenny’s” (+ 150 % since last year) and “Kaiser’s” are driving growth – the latter has five new locations in the pipeline for 2025. International fast food chains are also currently recording strong growth rates: KFC is expanding with a year-on-year increase of 73%, followed by Noodle King (+27%) and Dunkin’ Donuts (+24%).

At the same time, however, a clear consolidation is taking place, as not all companies are performing well: “Segafredo” is pulling back from many locations, “Nordsee” is reducing by 40%, and Subway is following the trend of store closures. The industry is reorganizing – with a clear focus on lucrative locations and contemporary concepts.

Grocery retail affected by store declines for the first time

This year, the grocery retail sector is also feeling the impact, increasingly focusing on optimizing locations. Unimarkt has closed nearly 20 stores, and Nah & Frisch is experiencing similar declines. The Billa Group reduced its network by 24 stores – only Penny is expanding slightly. The strategy is clear: Instead of widespread presence, grocery retailers are increasingly focusing on more profitable locations and optimizing their store concepts to adapt to changing market conditions.

Increasing Store Closures in Traditionally Stable Industries

Bakeries, long seen as an expanding sector, are now facing a slow erosion: Back-werk has closed a third of its stores, and M-Preis has reduced its baguette locations. Fitness studios, once a booming industry, are also struggling – for example, Mrs. Sporty now has significantly fewer locations than the previous year.

Specialized retailers in the sports, fashion, and jewelry sectors are hit particularly hard. More and more consumers are shopping online or at large generalists, which is threatening the survival of many specialty retailers. Gigasport has closed down stores, and Zentrasport had to file for bankruptcy in 2023 (though the restructuring process has now been successfully completed).The lingerie sector is also under pressure: Following Palmers’ bankruptcy, Calzedonia and Intimissimi are now shrinking their store networks.

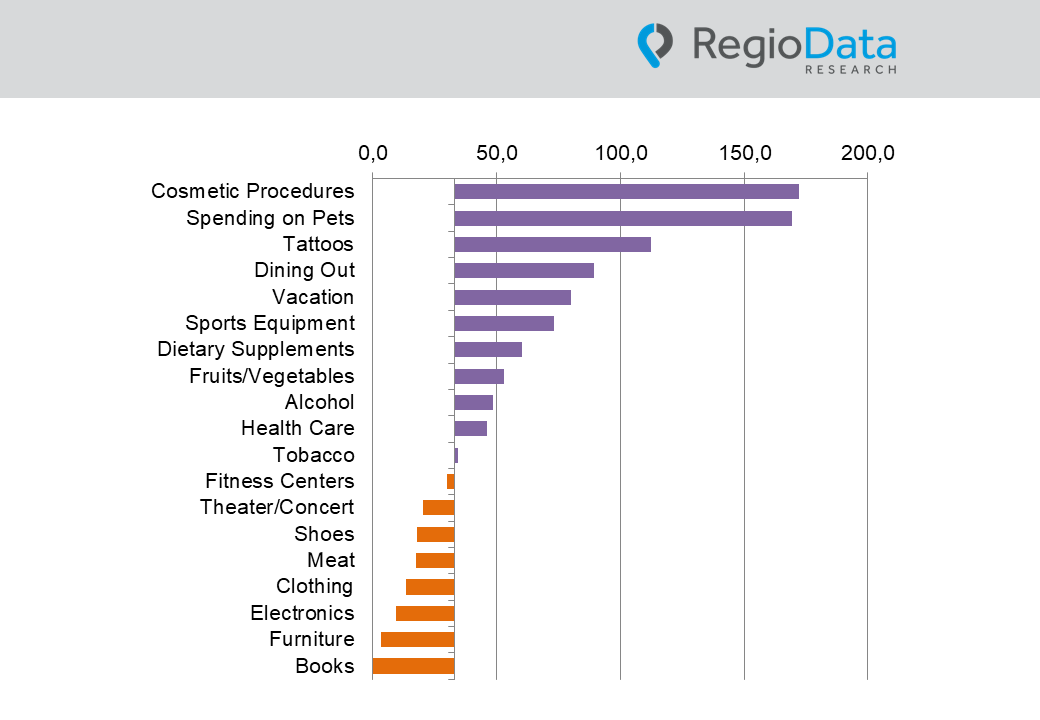

Online retail is intensifying the pressure on brick-and-mortar stores. Platforms like Temu attract consumers with a vast range of products – lingerie, sports goods, and jewelry are now available with just a click. Jewelry retailer “Bijou Brigitte” is responding by closing around 30 stores. The shift toward digital shopping is putting specialized retailers under increasing pressure.

Discounters Show First Signs of Slowdown

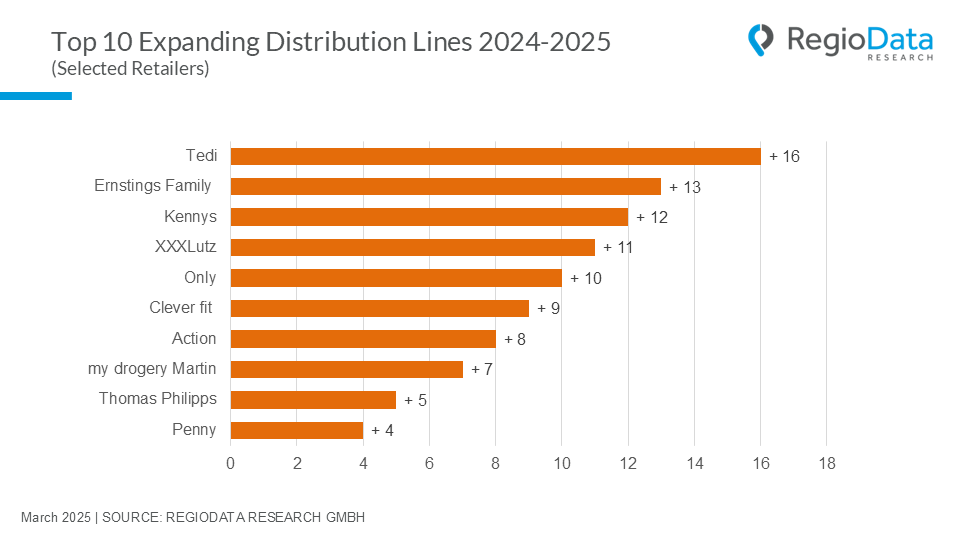

After years of rapid expansion, the leading non-food discounters – Action, Tedi, Kik, NKD, and Takko – are experiencing their first pause. Since 2019, their store networks grew by a third, but now overall growth has stalled. The number of locations remains almost constant. Only Tedi continues to focus on expansion with 16 new stores, followed by Action with +8. Thomas Phillips is also slightly expanding its store network.

New Locations: Strategic Adjustment Instead of Uncontrolled Expansion

Despite the declining trends in many areas, there are also signs of adaptation and innovation. Mono-brand stores are increasingly focusing on shopping centers, while grocery retailers are optimizing their store strategies. Pop-up stores and auto showrooms, such as those from “Polestar” and “Cupra,” are creatively utilizing vacant spaces. Particularly in Vienna, the massive flagship store of “Silhouette” shows that city-center locations are still attractive.

A noticeable feature of the current new openings is the preferred sales area of 101-200 m², while niche offerings for specific target groups are becoming increasingly relevant. These developments further emphasize the urgent need for retailers to adapt to changing consumer habits and creatively fill vacant spaces.

Conclusion

The retail landscape in Austria remains dynamic: While a few sectors, such as gastronomy and specific retail segments, continue to expand, major franchise systems and discounters are undergoing consolidation. New trends like mono-brands, pop-up stores, and the shift to city-center locations are shaping the future of retail.

Share post