AUSTRIA

Retail real estate is regaining its attractiveness

In the last 10 years, Austria has witnessed a general trend of decreasing prime yields in various types of real estate, such as office buildings, retail spaces, and residential properties. This was partly due to strong demand for real estate and limited supply. However, for the first time, a reversal of this trend is now emerging with an increase in yields.

This development is parallel to the trend observed in many European countries, leading to many investors and operators withdrawing from this asset class on an international level. Even renowned specialists such as ECE, Unibail, or SES have increasingly shown interest in other asset classes. Consequently, the number and volumes of such transactions have decreased.

Despite significant changes in the entire retail sector, distressed assets are still relatively rare. In general, the turnaround in shopping centers (malls, retail parks, hypermarkets, and factory outlet centers) was the first to occur, starting in 2018, and a positive development is still expected, albeit not too strong. The situation is similar for office properties. In contrast, there have been few transactions in larger shopping malls in recent years.

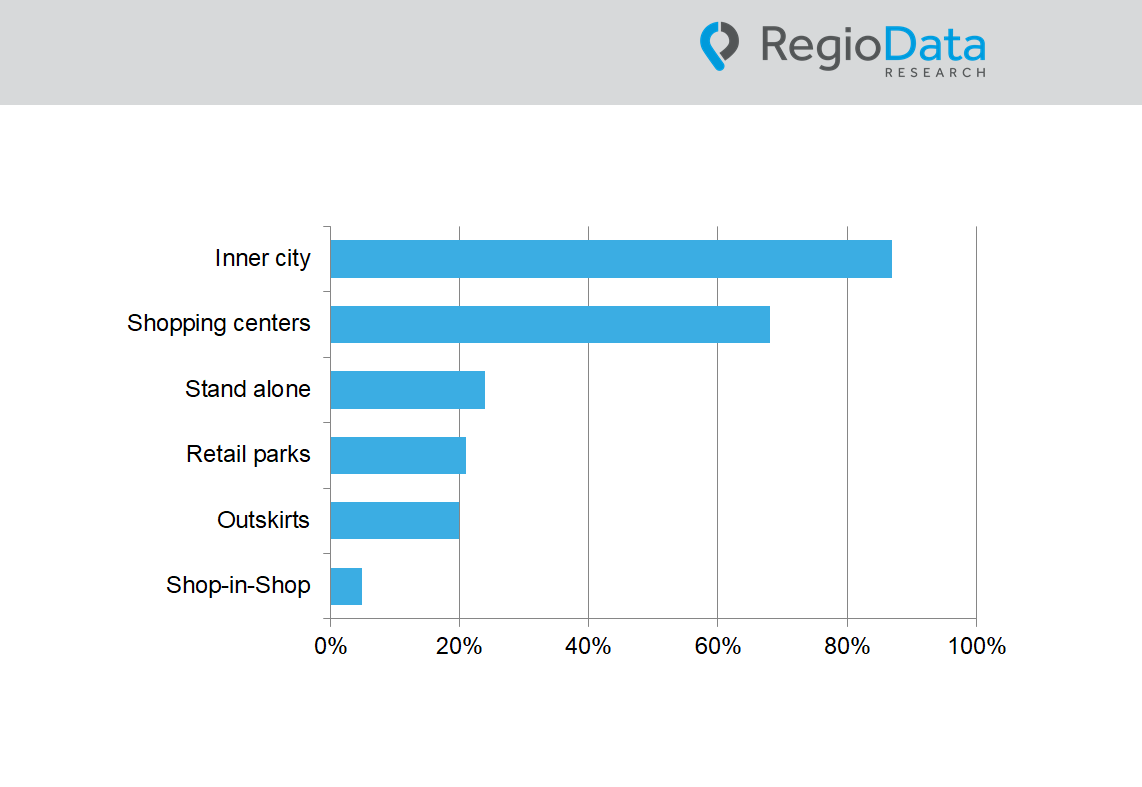

In Austria, for investors, smaller specialty market centers with local supply characteristics are particularly interesting in synthetic trading zones, although the supply is still limited. Currently, the most promising prospects are offered by good high-street properties with mixed use. In many cases, there is significant potential for optimization and a long-term positive outlook, especially considering many trends favoring the upgrading of central city center locations. While they may not offer the highest expected returns among all observed asset classes, they exhibit the most significant growth.

In light of these findings, it can be concluded that the currently increasing long-term prime yields for investment properties indicate that investors can achieve attractive returns from their real estate investments. Especially in the realm of shopping centers and high-street properties, promising opportunities arise.

share post