austria

Senior living - demand for serviced housing is growing rapidly

While there is already significant regional overcapacity in traditional residential construction, there is still a massive need to catch up in the “senior living” segment – especially when demographic developments are considered.

Seniors have specific housing needs and like to stay active

The days when seniors were shunted off to a nursing home, as far away as possible, are long gone. The “silver agers” of the current generation are, for the most part, mobile, fun-loving, want to live a self-determined life, and have increasingly achieved at least a modest level of prosperity.

The proportion of seniors in the residential population is also rising steadily – and so is the need for more varied and serviced forms of living beyond nursing homes and retirement homes. Independent and individual living with the possibility of active participation in the community and on-site care, which is particularly necessary in the case of physical impairments, is increasingly in demand.

Samantha Riepl, MA, CEO of SR Immobilien GmbH, specializes in the holistic consultation and conception of construction projects in senior and intergenerational living: “The majority of the population aged 70+ would like to remain or be cared for within their own four walls. However, due to the care dependence increasing with age, the necessity for migration into a barrier-free, senior-fair housing unit with support arises. The feelings of isolation and loneliness, as well as an increased need for support in everyday life, are the beating issues in old age. What is needed here is a conscious integration of seniors into a community and a minimum level of care while providing opportunities for retreat.”

“Assisted living” is rapidly gaining importance

Currently, there is a real boom in “assisted living” or at least “care-able living” meaning independent, private, barrier-free, and senior-friendly apartments in which seniors live independently but can fall back on support from a social institution (e.g. Red Cross, Caritas or similar) as required. There is also considerable market potential in “newer” forms of living, such as intergenerational living or retirement communities, where there is targeted support among residents.

Demand is growing strongly, supply is lagging behind

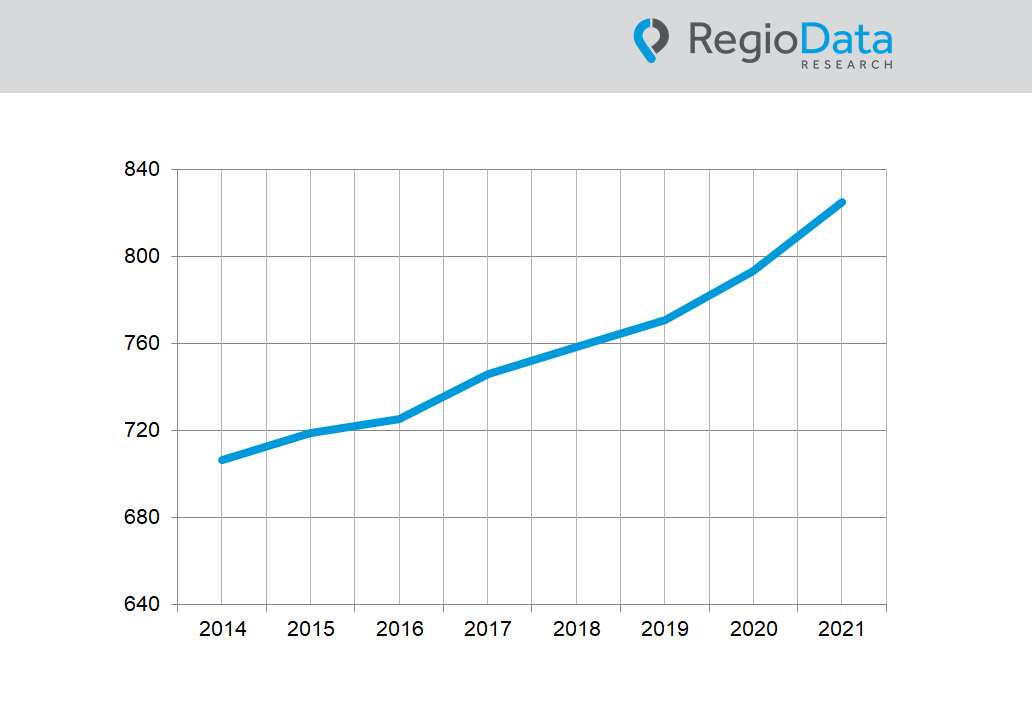

While there are currently around 844,000 people in Austria aged over 75, this figure will rise to 1.077 million in 10 years. This demographic change alone will mean that significantly more residential units will be needed for senior citizens in Austria, with a calculated demand for around 3,100 residential units per year in the “assisted living” sector.

However, current projects are introducing around 700 units to the market each year, resulting in a calculated shortfall of 24,000 residential units for “assisted living” over the next ten years. Despite the dynamic construction activity in this market segment, there is still a need to catch up. The shortfall for the next 10 years can be estimated at around 30,000 units.

Strong regional differences in supply

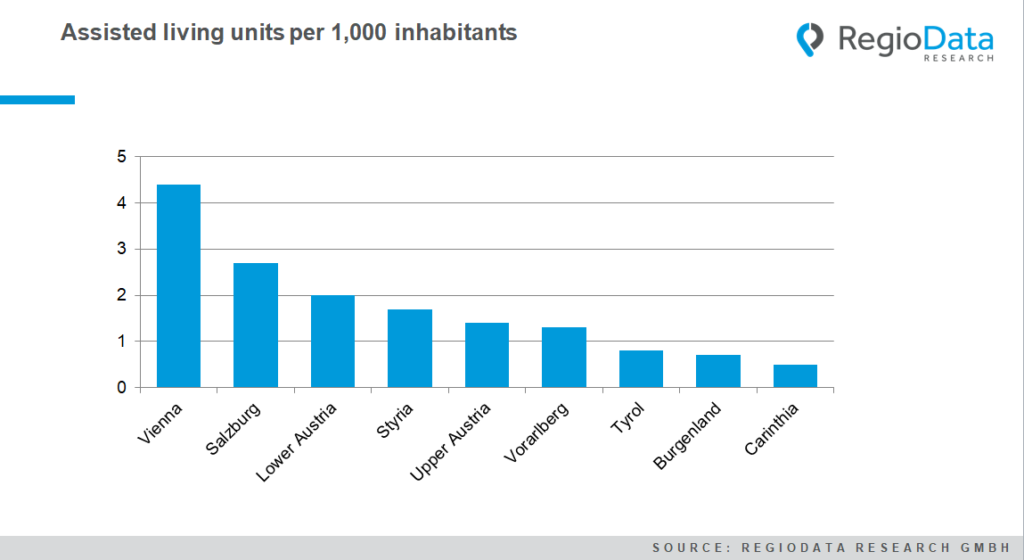

In regional terms, however, there are very marked differences in the provision of “assisted living” in Austria, as the latest evaluation of the RegioData Research database shows:

Vienna has by far the highest density of assisted living facilities, followed by Salzburg and Lower Austria. Carinthia and Burgenland clearly bring up the rear in terms of supply.

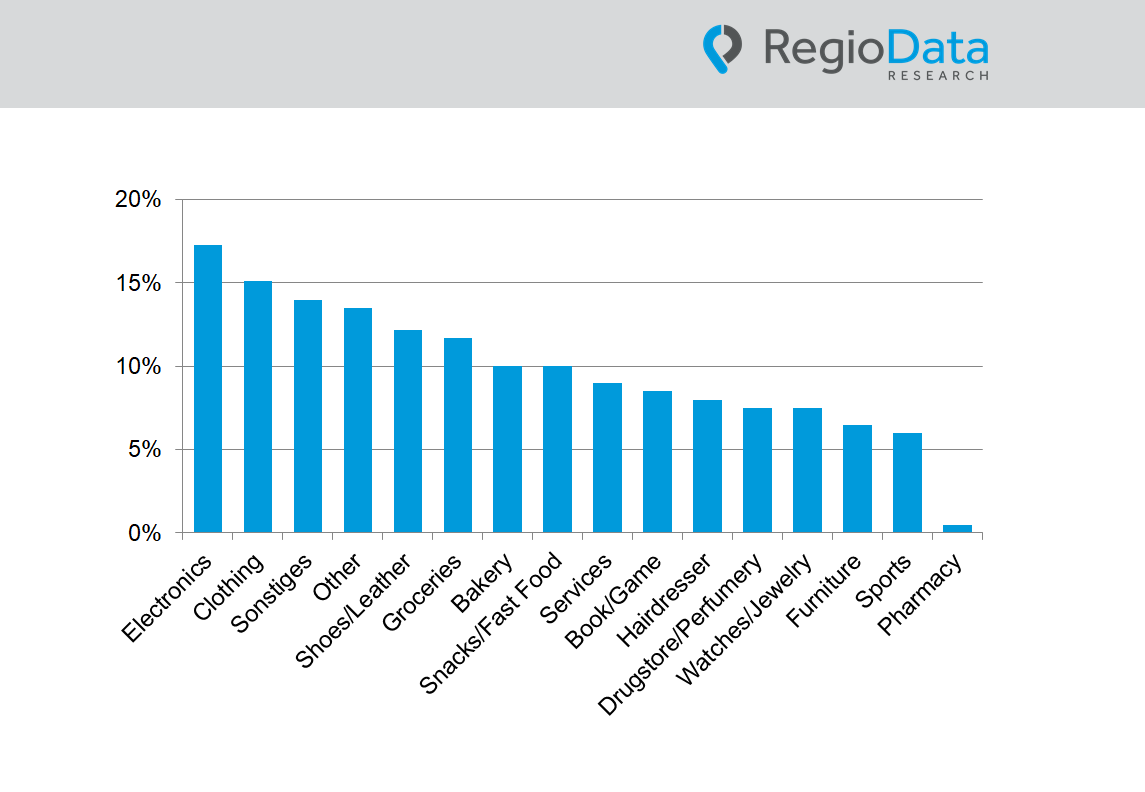

Seniors with high purchasing power want suitable apartments in good locations

At present, more than 90% of these “assisted living apartments” are still being built by non-profit developers, i.e. with massive public subsidies in some cases, but one market segment is gradually emerging in the mid-range segment for privately financed real estate developers and investors as well: Residential housing complexes for seniors with individually determined services and high-quality on-site care.

Samantha Riepl, MA of SR Immobilien GmbH sees a high dynamic in this market: “While the yields for standard apartments and offices are steadily falling, well planned and thought-out freifinanced senior properties can definitely bring significantly higher returns for investors. However, success is not always guaranteed, especially in this segment, because the wealthier seniors, in particular, are becoming more demanding. The stable rental income and low fluctuation promise stable returns. That is why this real estate segment is becoming more and more interesting for investors. The market demand exists, and so does the willingness to downsize in old age. The decisive factor here is not only the construction of barrier-free and senior-friendly housing complexes, but also the targeted selection of a professional on-site operator who can provide long-term structure, stability and foresight in care.”

share post