AUSTRIA

The downward spiral of stationary retail space continues to spin

The recent losses in purchasing power in this country – except for 2021, which saw a 1.2% increase in purchasing power compared to the previous year – which are primarily due to the pandemic as well as inflationary conditions, have caused quite a few things to change, as changes in purchasing power accompany changes in consumer behavior. The focus had to be directed again primarily on the necessities, such as housing and energy expenditures. Combined with changes in value attitudes, that means the retail sector, in particular, still has a battle ahead of it – because it will probably continue to lose importance.

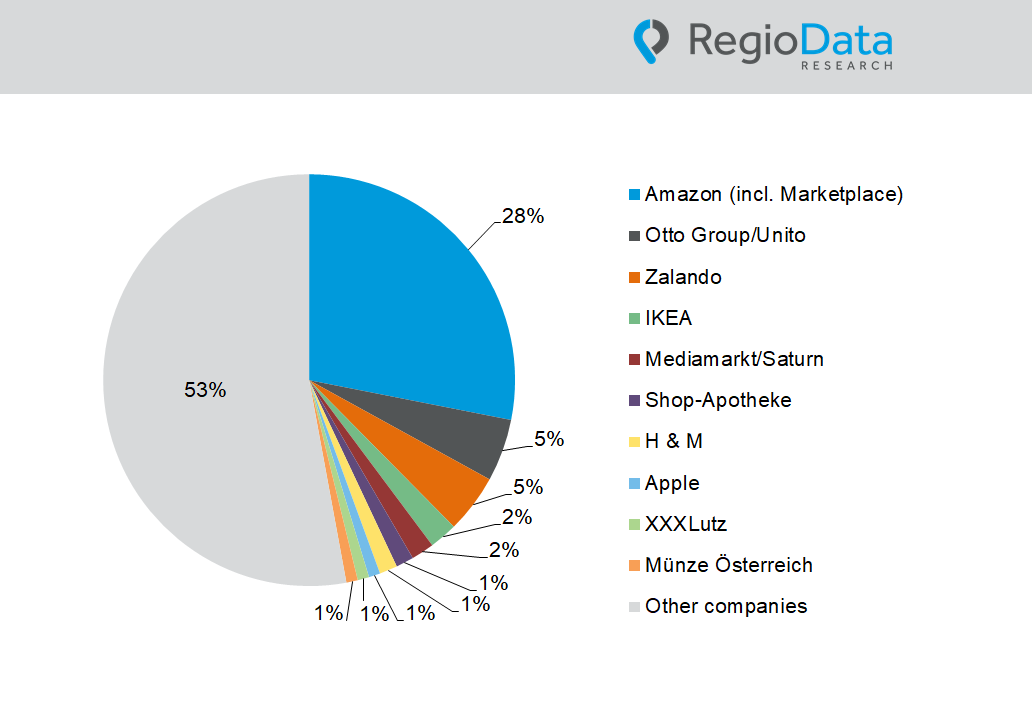

While gastronomy, for example, has doubled its share of consumer spending by Austrians since 2004, the retail share is steadily shrinking, namely from 36% in 2004 down to a currently forecasted 20% in 2024. The logical consequence: a continuous downward spiral in retail space in the Austrian retail sector, fueled by online pure players, Corona, and the Ukraine war, among other factors.

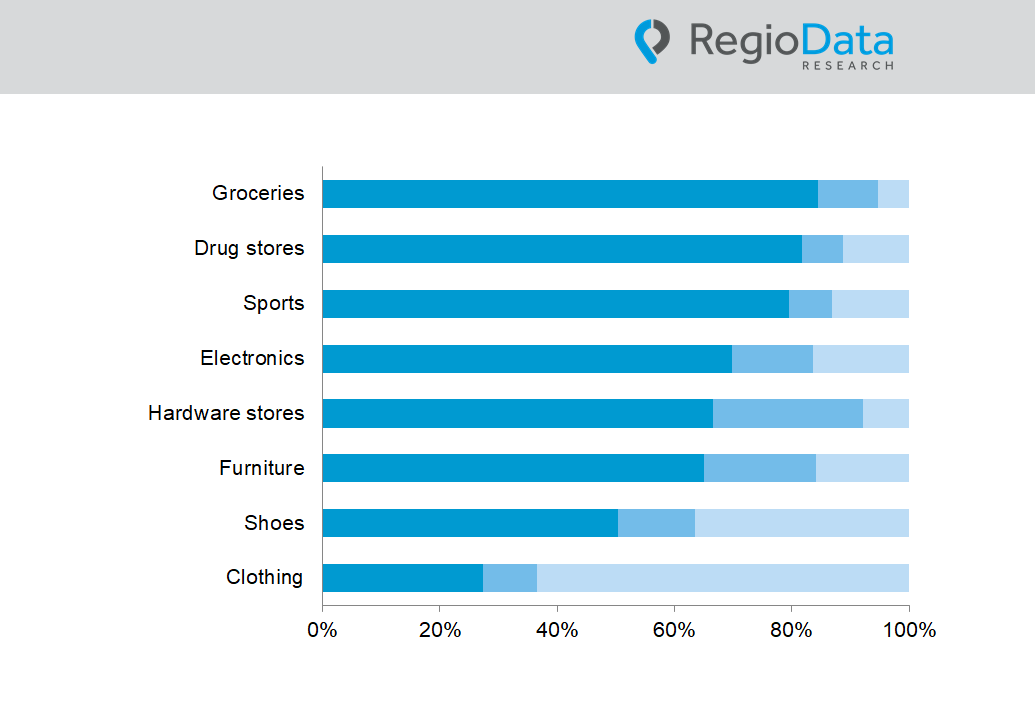

Generally, Austria has a total retail space of approximately 14 million m², which is still a top value in Europe. However, about 150,000 m² of this space is lost every year. Most of the growth in recent years has come from furniture stores, grocery stores, off-price stores, especially Action and TEDi, and sports stores. Moreover, the steepest declines were in the clothing trade, shoe retailing, and perfumeries.

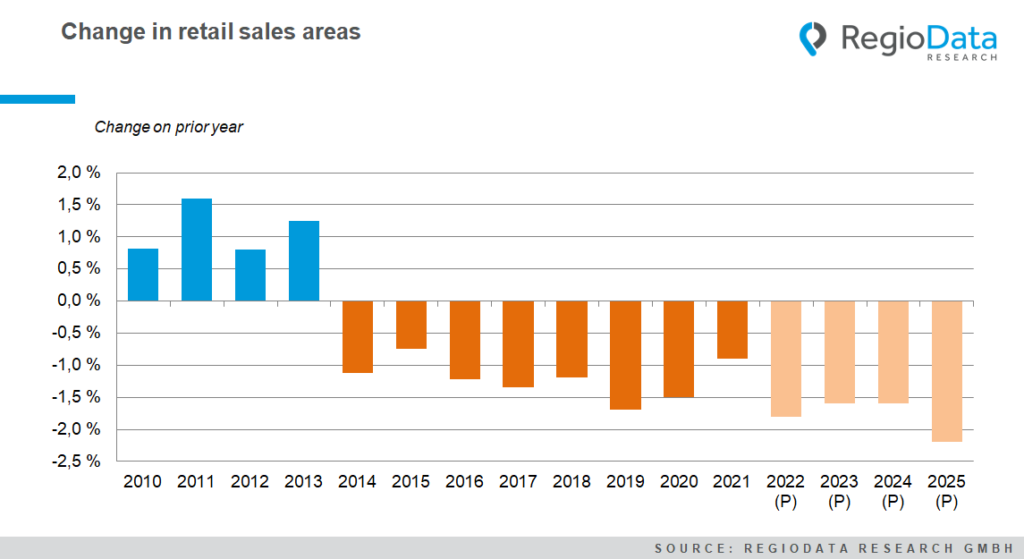

The turning point in the transition of retail space from growth to decline was in 2013, with the demise of Schlecker. In one fell swoop, a significant number of sales areas, particularly large ones, closed. Since then, however, the decline in retail space has been relatively constant at around -1 to -1.5%.

It is also interesting to note the year 2021, where dramatically more declines were expected, due to the Corona closures, but, quite the opposite, there were less closures found. It could also be due to the support measures of the federal government, among other things.

And for 2025, further momentum in closures can be expected, as grocery stores are also likely to start closing retail space in the next few years.

All in all, sales areas in the Austrian retail sector are declining, but at a relatively slow pace. There is, therefore, still some time to react accordingly.

Share post