AUSTRIA

The grocery retail is remodeling

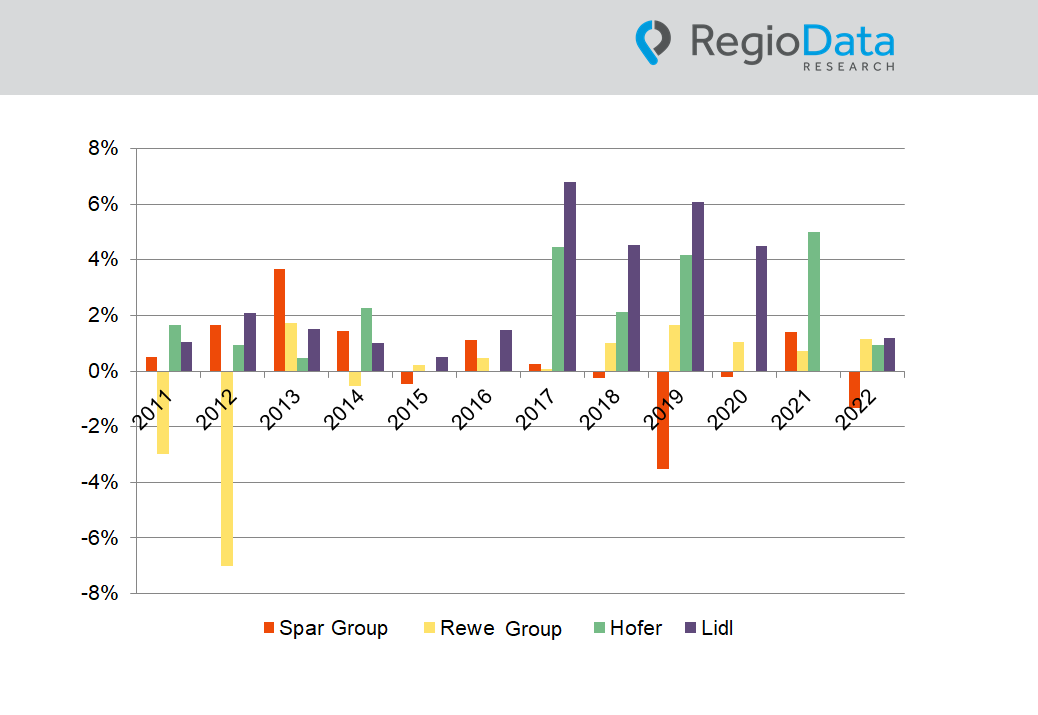

Sales in the food retail sector are rising steadily. Growth rates have been far above inflation for years. An increase of 4.5% is expected for this year. However, significant changes are becoming visible within the industry.

Nearly one-third of all consumer spending goes to food retailers

At € 23 billion, food retailing is, by far, the largest and most important retail sector in Austria. Over 31% of all retail spending goes to the approximately 5,700 grocery stores. By comparison, the second-largest retail segment, the clothing trade, can only tie up around 9% of retail-related spending.

Corona brings unexpected sales growth

During the lockdown, that lasted several weeks, food retailers benefited in multiple ways: The closure of the gastronomy sector resulted in regular meals at home and corresponding purchases, which got reinforced by the sudden onset of home-working. Finally, food retailers – especially Interspar, Hofer, and Lidl – generated additional sales from non-food items that could not be bought elsewhere, such as gardening items or toys. From today’s perspective, this will result in sales growth of 4.5% for the sector at the end of the year and presumably return to the long-term average range of just under + 2.5% in 2021 – despite the expected loss of purchasing power among broader sections of the population.

Expansion only in new construction areas

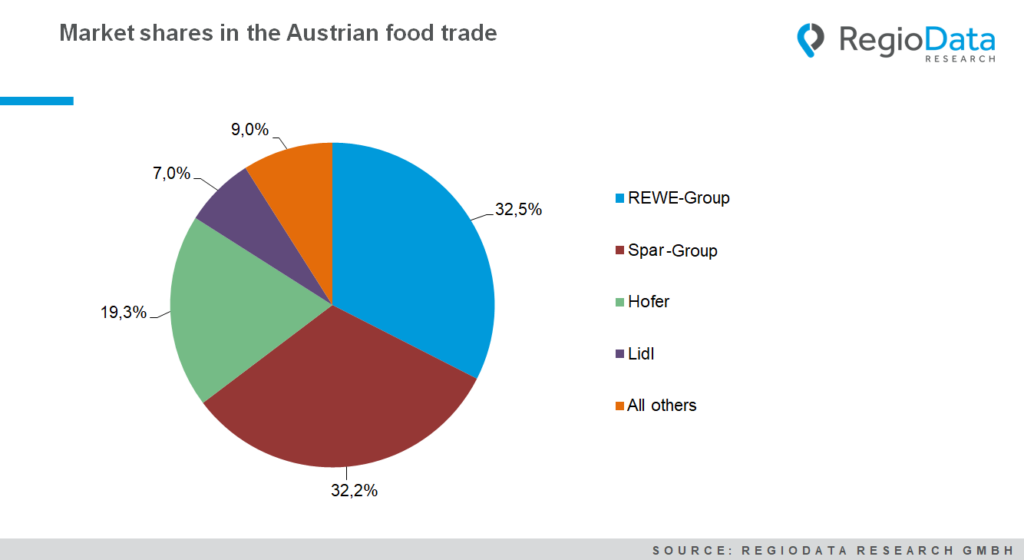

Little has changed in terms of market conditions: The “Big 4” REWE, Spar, Hofer and Lidl cover 91% of the total market – a remarkably high concentration rate even in international comparison. While REWE, Lidl and Hofer have expanded in recent years (+ 127 new locations in the last 3 years), the Spar Group has reduced its locations (- 62 locations in the last 3 years). At present, the urge to open new locations seems to have subsided, unless interesting new locations arise in the major urban development projects such as Vienna and Graz.

Discounters unable to expand market share

Although Lidl and Hofer are expanding and have opened a total of 65 new stores or expanded existing ones (e.g., by adding a bakery store) in the past three years, the market share of discount stores in Austria is 30.6%, the same as three years ago.

Unification of the business types

The variety of store types is decreasing: The small supermarkets (with less than 600 m² sales area) and large hypermarkets (with over 3,500 m² sales area) are gradually disappearing. Currently popular and economically successful types of businesses are those around 800 m² for supermarkets (e.g. Billa, Spar) and 2,500 m² for hypermarkets (e.g. Merkur). And discount stores are also getting bigger and are adapting to supermarket formats with around 800 m².

Organic, natural, domestic, fair, regional and ecologically correct

In the long term, the values of many consumers are changing when buying food. The regular, substantial sales increases in the industry are also due to the higher-quality goods and less to price increases. Recently, product attributes such as “from the region” or “from Austria” are popular, probably due to the general closing of ranks in a crisis. On the mid-term, however, it is to be expected that this trend will weaken significantly again.

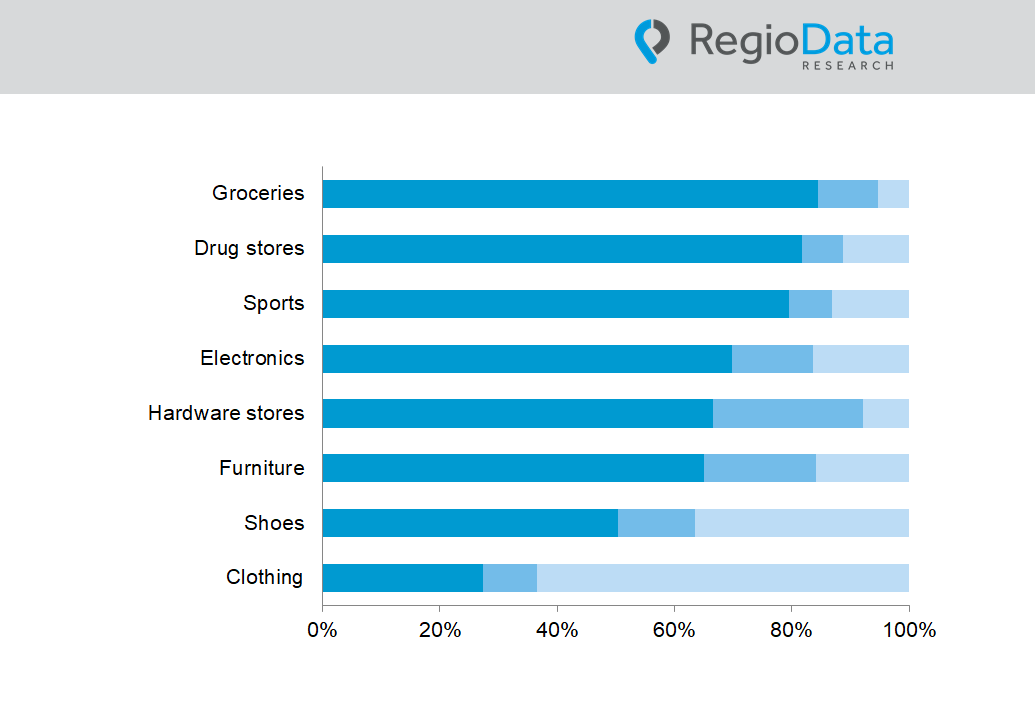

Immune to online

While retailers in other sectors complain about online shares of up to 30%, food retailing seems immune to this. Only 2.8 % (before Corona: 2.5 %) of household food expenditure is currently transacted online, and these are mainly sub-ranges (e.g. wine) or special products (e.g. Sachertorte). That is probably due to the fact that Austria has an extraordinarily high density of retail space in the food trade. One can find a supermarket on the corner of every house and every traffic circle. And for consumers, it is significantly more convenient to quickly go to the store than to order on the Internet and arrange a delivery date – and this will probably remain the case for some years to come, even though international providers (e.g., Amazon Fresh) are already preparing to enter the market.

Share post