Europe

Factory Outlet Center - Completely immune to online retailing

While stationary retail across Europe has been declining for years, factory outlet centers are thriving. In total, the sales area of the 180 outlet centers is now approximately 4.6 million square meters, compared to 3.3 million square meters a decade ago. This represents a growth rate of nearly 40%, and an additional 18 projects are in planning.

Two-track retail landscape

The trading landscape in Europe is becoming increasingly polarized overall, not least due to the numerous crises in recent years. On one hand, the low-price segment is experiencing a very robust development, leading discount retailers to continuously gain market share and space from other market participants in virtually all industries.

On the other hand, the high-end segment, which appeals to the actual target audience of outlet centers, is also pushing forward strongly. In this regard, higher-end branded products are experiencing a significant increase, which is driving the expansion of factory outlet centers in parallel. Within the clothing retail sector, outlet centers are already showing as the only sector with high dynamism, while other forms of retail are under pressure, especially from the shift to online shopping. Despite the increasing proliferation of factory outlet centers over the years, the market share of outlet malls remains marginal everywhere, amounting to less than 1%, with this development varying significantly regionally.

True shopping experience

Factory Outlet Centers cater to the international megatrend towards branded products, benefiting from an agglomeration advantage due to the unique concentration of branded goods not found elsewhere in physical retail, and a clear marketing strategy (“30 – 70% cheaper”). The previous image of faulty or outdated goods has long been discarded, as have the perceptions of cheap store furnishings. With their often romanticized architecture and additional offerings in gastronomy and leisure, they create a shopping experience for a broad range of customers – including tourists.

Great Britain – the home of outlet centers

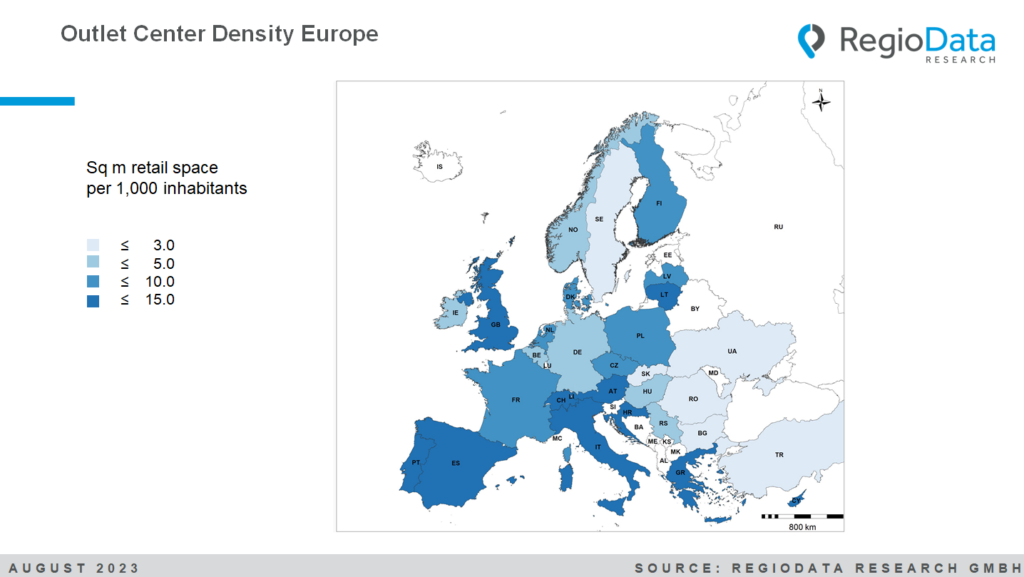

Although the first outlet center in Europe opened in France, this distribution format has been deeply rooted in the United Kingdom from the very beginning. In just the past 10 years, the area of outlet centers in the UK has expanded impressively by 77%, currently reaching 721,000 square meters. Presently, the UK boasts a remarkable sales area density of 10.8 square meters per thousand inhabitants.

In addition to the UK, Austria and Switzerland also have a significant number of outlets, with densities of approximately 11.0 and 10.0 square meters, respectively. In some parts of Southern Europe, there is also a noticeable clustering of outlet centers, with densities ranging from 10.0 to 12.0 square meters per thousand inhabitants. This is partly because these areas are tourist hotspots, and tourists are a very significant target audience for factory outlet centers.

The lowest sales area density falls in the range of 0.5 to 3.0 square meters and can be observed in countries such as Romania, Bulgaria, Turkey, and Ukraine. Although Sweden has the highest density of shopping centers overall, it ranks towards the bottom in the context of outlet malls in Europe.

The main operators in Europe

Among the over 180 locations, McArthurGlen is the largest operator in Europe with 24 locations and over 3,000 brands. The British group has established designer outlets in various countries, including Italy, France, the United Kingdom, Germany, Spain, Austria, and the Netherlands. Following closely in second place is the Spanish group Neinver, founded as early as 1969. ROS Retail Outlet Shopping, based in Vienna, is the third-largest operator in Europe. The company was founded in 2011 and is primarily active in Central Europe and parts of Southern Europe. Another major operator is Via Outlets, with 11 outlet centers in Europe.

Future projects: Outlet expansion in the pipeline

The future of Factory Outlet Centers promises exciting developments. Germany, which has long lagged behind in Western Europe, is planning expansions totaling around 69,000 square meters by 2024. With an expected expansion of approximately 87,500 square meters by 2024, the United Kingdom currently has the largest outlet center growth planned. This reflects the enduring popularity of outlet shopping options in the British retail landscape. France is also focused on expansion, with planned additional 59,400 square meters by 2024. These initiatives underscore that Factory Outlet Centers will continue to play a significant role in the retail sector and respond to the increasing demand for diverse shopping experiences.

Outlet Center in Austria

The first Outlet Center in Austria was established in Parndorf back in 1998, much to the dismay of retail industry representatives at the time. Currently, there are three centers in Austria: two in Parndorf and one in Salzburg. Additionally, there are two locations near the Austrian border, specifically at the Brenner Pass and in Kleinhaugsdorf. The two centers in Parndorf have a combined area of over 70,000 square meters, making them the largest outlet aggregation in Europe. After these outlet centers suffered greatly during the COVID-19 pandemic (due to lockdowns, no tourists, and reduced consumer spending), they have now returned to pre-pandemic levels, despite the meantime increase in online shopping.

Share post