Europe

Shopping Center Density: The gradual rise of Southeastern Europe

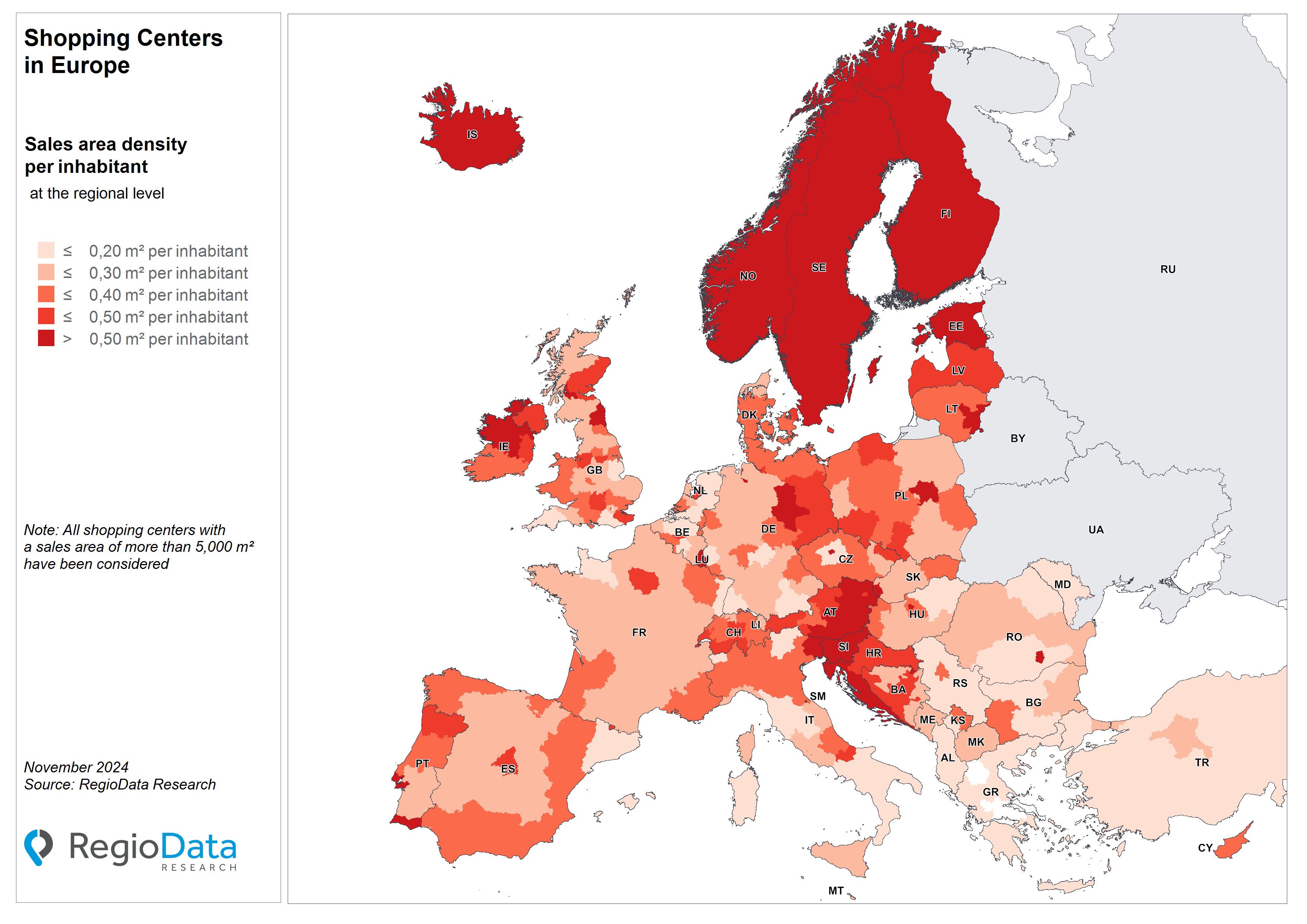

The shopping habits of Europeans are undergoing significant changes, which in turn are reshaping the retail landscape. While some countries continue to focus on large-scale shopping centers, other regions are making substantial progress. A look at the current shopping center density in Europe reveals a pronounced north-south and west-east divide. Even within individual regions, there are significant differences in retail space density per capita.

In the northernmost parts of Europe, the trend remains largely unchanged: Sweden, Norway, and Finland boast values well above 0.50 m² per capita. Norway leads with 1.04 m², continuing a long-standing Scandinavian approach of developing expansive shopping centers that connect sparsely populated areas and serve as central retail hubs.

San Marino holds the top spot in Europe with an impressive 1.4 m² of shopping center space per capita. Close behind are Monaco with 0.89 m² and Luxembourg with 0.85 m². The Baltic region also demonstrates above-average density, with Estonia standing out at 0.78 m² per capita, highlighting the growing importance of this region in a European context.

In Central Europe, some regions exhibit similarly high densities of shopping center space, with Austria leading the way. The regions of Styria, Lower Austria, and Carinthia each have around 0.60 m² of retail space per capita. Burgenland takes the national lead with 0.93 m², placing it among the top 10 regions in Europe. Overall, Austria’s national average of 0.50 m² is significantly higher than the European average.

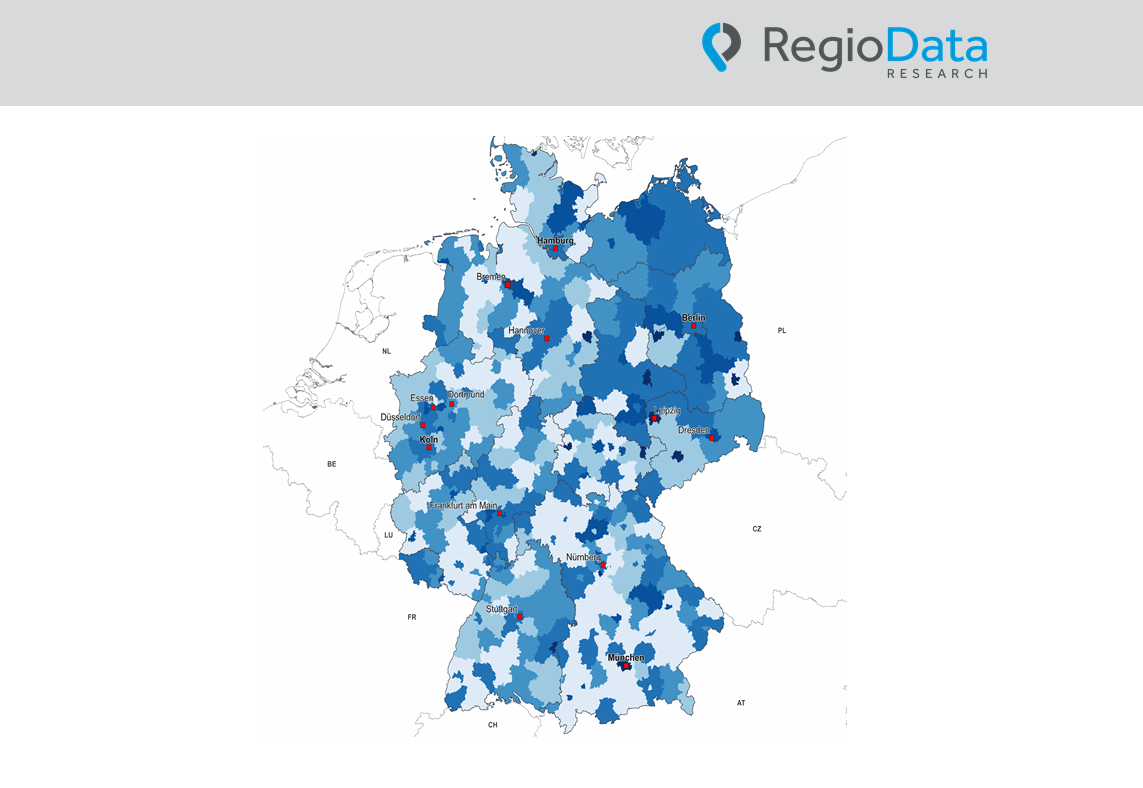

Germany, France, and Poland also perform well, with retail space densities ranging from 0.30 to 0.50 m² per capita, reflecting solid and well-developed infrastructures. In Germany, there is a pronounced east-west divide, with eastern Germany exceeding the national average in retail space density.

Southeastern Europe is currently showing remarkable dynamism. Just a few years ago, countries like Bulgaria, Romania, and Greece had retail space densities typically below 0.10 m² per capita—a clear lag in the European context. Today, some regions have moved into the middle category. Although the average density of 0.20 m² per capita remains below the European average, the upward trend is unmistakable.

Notable progress is evident in Bosnia and Herzegovina, which now boasts an average retail space density of 0.43 m². Croatia, with 0.52 m², and Slovenia, with 0.55 m², have also become frontrunners in the region.

Despite these advancements, parts of Eastern Europe, such as Ukraine and certain regions in Turkey, remain significantly behind due to underdeveloped markets.

While shopping centers in Western and Northern Europe are increasingly evolving into leisure and entertainment destinations, they continue to serve as central retail hubs in economically weaker regions. In the coming years, demand for shopping centers is expected to rise sharply in Eastern and Southeastern Europe. In contrast, Western Europe is focusing more on “experience shopping,” integrating dining, entertainment, and recreational activities.

Share post