europe

Shopping Centers in Europe: Only Eastern Europe remains dynamic

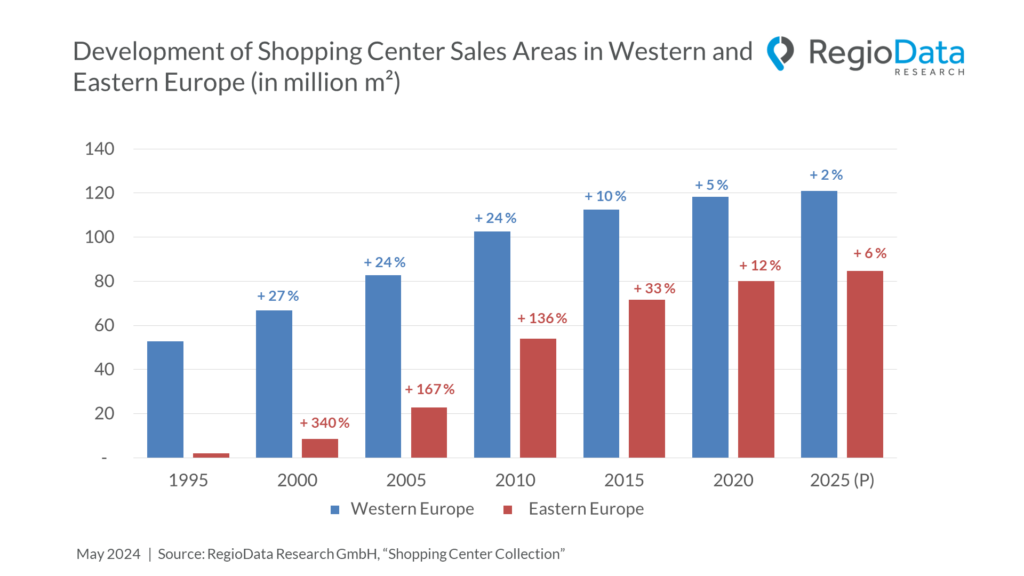

While the retail space of shopping centers[1] in Western Europe gradually expanded over many decades, it experienced a real boom in Eastern Europe in the 2000s. RegioData Research has compared the development of shopping center space in both European regions over the last 30 years in detail.

Overall, people in Europe currently have access to around 205 million square metres of shopping center space. This represents an increase in retail space in Europe of almost 280% since 1995.

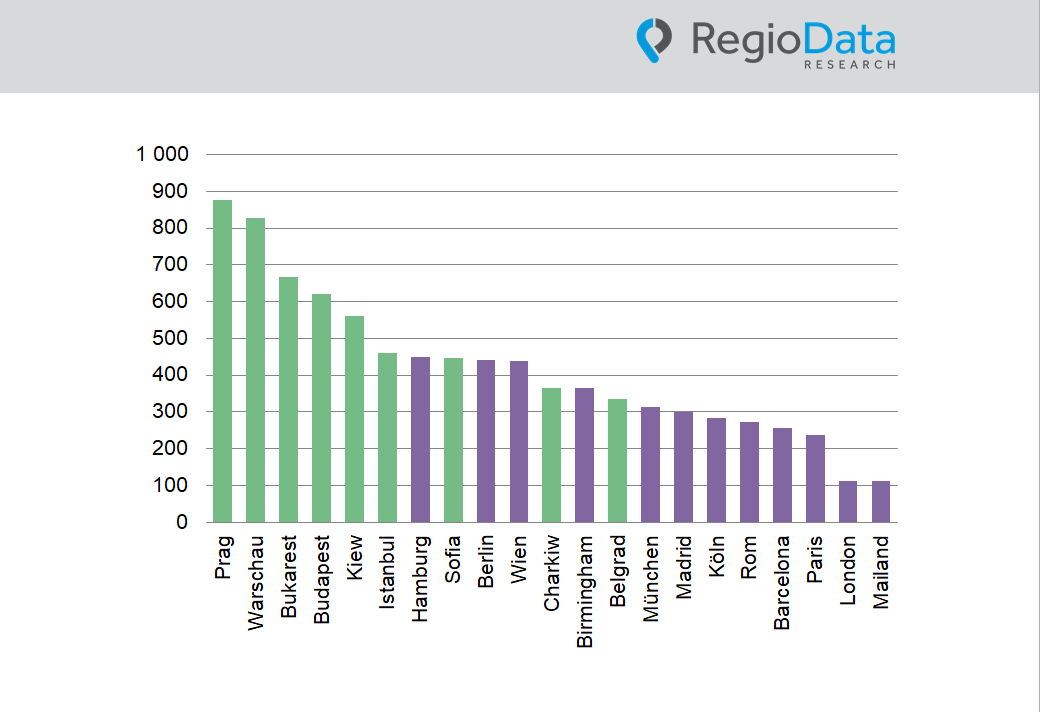

Remarkably, the existing spaces in Eastern Europe were developed in just about 20 years, whereas Western Europe took approximately 60 years for similar development. Starting from 1995, growth rates in CEE/SEE (Central and Eastern Europe/Southeast Europe) took on particularly dramatic proportions, driven by changes in economic systems in many CEE/SEE countries and the subsequent sense of opportunity fueled by Western capital.

Looking at the period after 1995 in 5-year intervals, retail space more than doubled in each of these intervals up to 2015. In 1995, the shopping center area in Eastern Europe was just under 2 million square meters, while by 2010, it had reached nearly 54 million square meters.

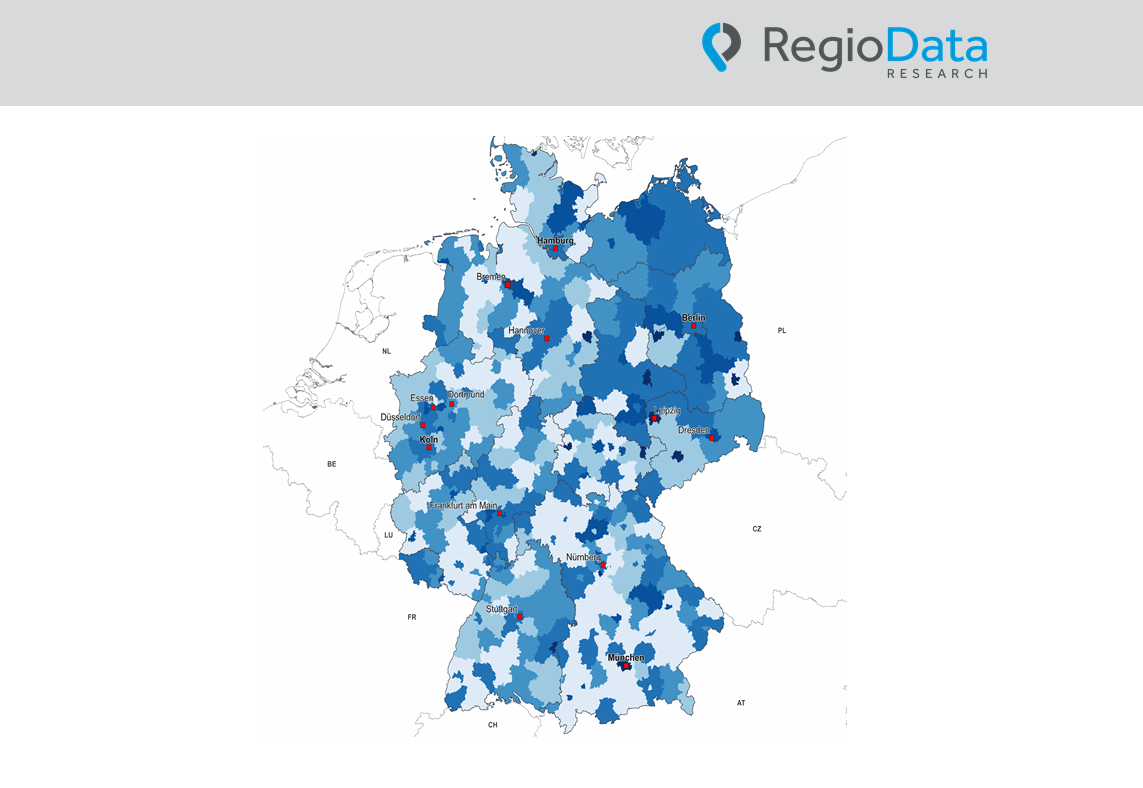

Western Europe also recorded considerable growth until the 2000s. However, larger leaps were observed in Western Europe in the decades prior, for instance between 1990 and 1995 (+40%). Regarding sales area density, Western European countries, especially Scandinavia, still lead clearly. Only the Baltic states, Croatia, and Slovenia also achieve similarly high values.

Overall, the pace of growth has significantly slowed across Europe, especially since the onset of the COVID-19 pandemic. While Eastern Europe still shows a certain dynamism with an increase of 1.2% per year, Western Europe is experiencing practically stagnation at +0.4%. In some countries like Germany, Spain, and Italy, the area of shopping centers is even starting to decrease again, as large hypermarkets and small, largely outdated centers are being abandoned or repurposed.

In the RegioData database, there are currently about 150 shopping center projects listed, totaling approximately 3.6 million square meters, slated to open by 2027. However, experience shows that only about half of these projects will actually be realized. The largest projects currently are located in Milan (Westfield), Madrid (Valdebebas), and in Ondres, France (Les Allées). However, most new constructions are significantly smaller than 20,000 square meters.

Although there is currently significant caution in the industry, the ‘era of shopping centers’ is far from over. Apart from commerce and the widely discussed ‘experience factor’ increasingly attributed to shopping centers, the focus in the future will primarily be on redefining their utility and creating additional value for visitors—particularly through the optimization of existing centers.

[1] Shopping centers = shopping malls, retail parks, factory outlet centres, hypermarkets > 5,000 m² rentable area

Share post